Editing by Xin Lanhua

The Indian government's revisions on foreign direct investment (FDI) terms since April 2020 have severely restricted Chinese companies from investing in the country. However, there came one recent application approval for a Chinese mechanical equipment project.

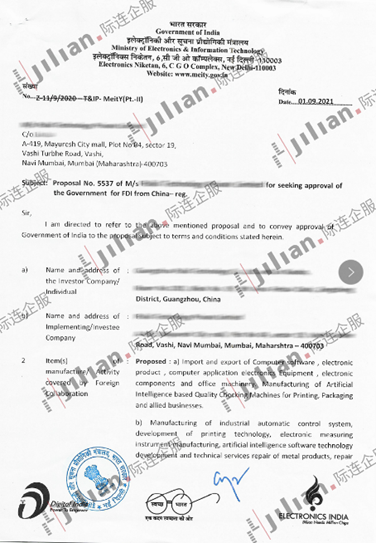

Source: Jilian Consultants

“This is an encouraging sign,” said Wan Jun, head of Shenzhen-based Jilian Consultants(际连企服), a consulting firm handling China-India investment cases. Many Chinese companies are waiting in line with interest in going to India.

Wan Jun disclosed that they had received approval documents from the Indian government.

After the COVID-19 pandemic broke out, the Indian government adjusted its investment policy towards its neighboring countries.

On April 17, 2020, the India Ministry of Commerce and Industry suddenly revised Article 3.3.1 of the FDI policy. It required all direct or indirect investment from the country's land neighbors to change from the "automatic approval route" to the "government approval route."

The “automatic approval route” was previously applicable to most industries. The revision is said to be based on concern for Indian's assets from being acquired by bottom fishing speculation during the epidemic.

Apart from this policy revision, with a relatively weak impact, the COVID-19 pandemic and worsened Sino-Indian relations almost suspended Chinese companies from investing in India over the past one and a half years.

The projects by GWM(长城汽车), Huaqin(华勤), Sunwoda(欣旺达), and some other small and medium-sized companies became blocked by the Indian FDI policy modification, with no approval yet. Despite these barriers, various industry sources told JW Insights that Chinese companies have remained interested in investing in India.

Referring to the latest green light to the project handled by Jilian, Wan Jun disclosed that the company is a relatively less known one, and the business is related to mechanical equipment for manufacturing facility construction. She did not provide any other details.

Meanwhile, she said that those Chinese projects by well-known companies with bigger investment scales are still not approved.

"Before the policy change, the enthusiasm of China's enterprises toward investing in India reached a peak. We used to handle nearly 200 applications every year. But since last April, we have helped 50 companies or so, and only one is approved." Wan said.

Almost two years have passed since the pandemic, and the Indian situation has been put into gradual control with more vaccines given. This first approval for China's input is expected to encourage other Chinese investments. Wan pointed out that although the prospect of the bilateral relationship is not bright, India's Made in India initiatives cannot be achieved without Chinese investment.

India's new FDI approval procedure requires sequential review by different departments, which the Indian government did not use before. There is no standard for this procedure, which may be a reason for the lengthy approval time.

Now the fact that one case has been approved. Being optimistic, she expected this would indicate an acceleration of approval for other applications. A dozen electronics and medical care companies have approached Jilian for investment consultations in recent weeks.

Observers said that India has quite a big market space on consumer electronics and electric vehicle markets from the supply chain perspective because of the country's demographic dividend.

An electronics industry insider said, "In the short run, the risk in the Indian market is high. But from the perspective of attitude and behavior of consumers, we can see that the demand continues to rise. So Chinese companies are still willing to invest in India, and they are being suppressed temporarily".

Wan also gave suggestions to firms intending to apply for Indian approval. First, increase the registered capital of the Indian company to be registered to one million rupees or above. Second, there must be profit in the audit report of the shareholder company. Otherwise, the Indian officials may consider the company unqualified. Lastly, the business plan should cover employment in detail to indicate your ability to contribute to the local jobs and economy.

登录

登录