By Kate Yuan

Listed Chinese semiconductor companies saw slowed growth pace in the third quarter of 2022, pointing to a new state of the country’s industry. JW Insights reported on November 30 after analyzing the Q3 earning reports of 175 A-share listed semiconductor companies.

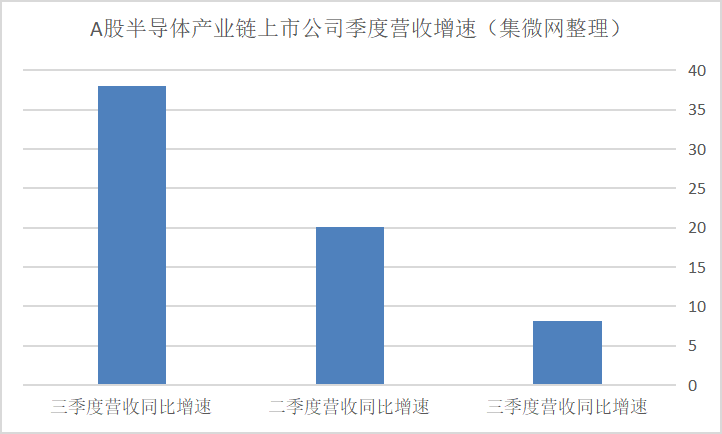

China’s semiconductor industry enjoyed encouraging development in the first half of this year. However, the Q3 results have shown a sudden change. The total revenue of 175 listed companies in Q3 was RMB182.5 billion ($25.75 billion), a year-on-year increase of 8.1%, a striking gap compared with the 38.05% growth in Q1 and the 20.15% in Q2.

This is also consistent with the global semiconductor industry sales, which totaled $141 billion in Q3, dropping 3.0% over the previous year. The global sales in September even slipped, for the first time since the beginning of 2020, according to the latest statistics from SIA.

The upstream and downstream companies in China also showed differential performance. JW Insights classified the 175 firms into 16 market segments, covering EDA/IP, equipment, materials, components and distribution.

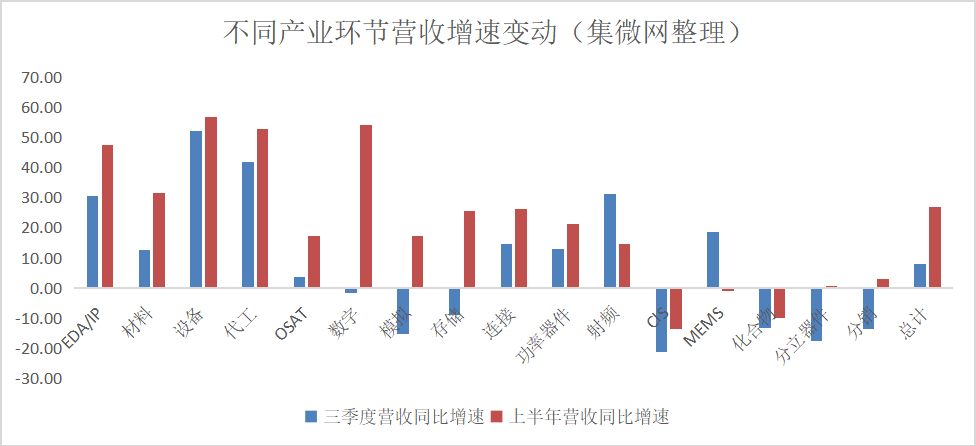

In Q1, only CIS, MEMS, and compounds companies registered negative growth rates in earnings. In Q2, analog, discrete devices, and distribution firms joined the ranks. Revenues of memory and digital chip companies also turned negative in the third quarter, highlighting an expanding and deepening trend.

Upstream industries including EDA/IP, materials, equipment, OEM, and OSAT showed much more robust growth resilience, and all maintained year-on-year and quarter-on-quarter growth in Q3 compared with downstream brands and distributors. Among them, quarterly revenue of EDA/IP, equipment, and OEM surged by more than 30% year on year.

Operational efficiency is facing challenges too. From January to September this year, the 175 listed companies contributed RMB67 billion ($9.47 billion) net profits to their parents, up 4.8% from last year’s RMB64 billion ($9.04 billion). As a comparison, the growth rate was 19% in the first half of the year.

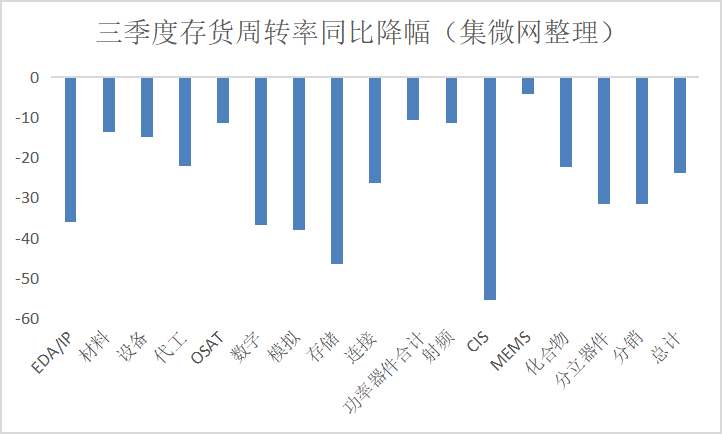

The turnover efficiency of inventory and accounts receivable of these companies has also declined. Taking inventory as an example, the cumulative inventory turnover rate of all shortlisted companies fell to 4.19 in Q3, an average drop of 23% compared with the same period last year. The decline means related companies may face pressure to reduce inventory.

The secondary market also lowered semiconductor companies' valuations in the second half of this year. The valuation of newly listed companies has gradually shrunk since August this year, hitting the lowest level since 2019, JW Insights found.

Mi Lei, the founding partner of Casstar (中科创星), a core technology investment house, told JW Insights that overvalued semiconductor startups and investment institutions are under severe challenges.

“The top priority for companies should be to focus on certain businesses and do what they are best at. Some startups have too many product lines. It is only possible to survive by striving to become the top players in certain markets relying on their own products and technologies, " Mi said. Some PE and VC institutions may face shrinking investment values or having to quit their play after this round of two-year investment peak.

In terms of new opportunities, Mi Lei noted that the bottleneck technologies for China are still worth investing, referring to the technologies that are related to or under US sanctions on Chinese companies.

In addition, he singled out photonic chips representing a next generation of cutting-edge technology as a good choice.

“Many new chip technology systems including silicon photonics are still in their infancy. China’s gap in photonic chips is not as large as in IC with the world, which could brings us huge chances,” Mi said.

“Moreover, China is now the world's largest AI market that is the largest application field of photonic chips. This could greatly boost the domestic photonic chip industry chain.”

Mi added that upstream component is also a valuable sector for investors. With the prosperity of the semiconductor equipment market, some component companies have won decent investment value in revenue and profit growth.

登录

登录