Editing by Greg Gao

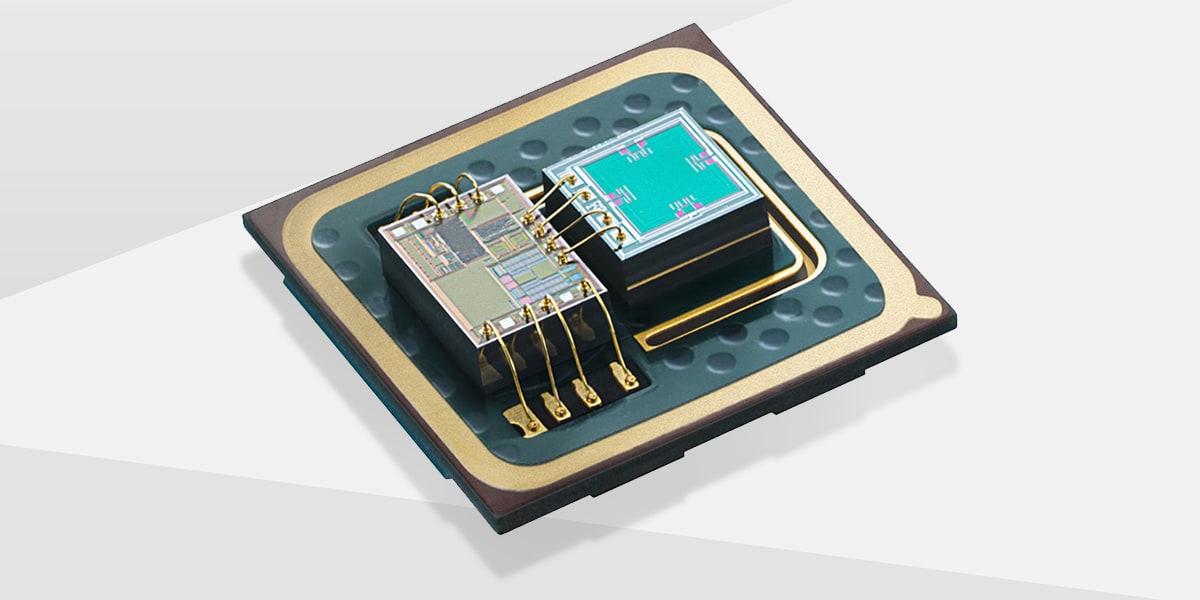

China's MEMS sensor industry has entered the fast lane of development with surging demands for consumer electronics, automobile, and medical devices, as well as favorable government policies.

Suzhou City in eastern China's Jiangsu Province recently held the China MEMS Manufacturing Conference, and representatives from the leading Chinese MEMS companies attended the three-day event. They reviewed and discussed the industry's progress and challenges.

"MEMS sensors are an opportunity for the Chinese IC industry. The downstream market is huge, and new demands are beyond imagination, " commented Li Gang, founder, and chairman of MEMSensing(敏芯股份), one of the earliest Chinese MEMS sensor providers.

The statistics from market research firm Huaon.com show that China's MEMS industry has maintained an annual 20% growth rate in recent years. Even in 2020, when the Covid-19 pandemic hit the economy hard, the MEMS market growth rate in the country still reached 23.2%. The market is estimated to exceed RMB100 billion($15.68 billion) in 2022 and RMB127.06 billion($20 billion) in 2023.

AAC Technologies(瑞声科技), MEMSensing(敏芯股份), and Silan Microelectronics(士兰微) are examples of the leading and promising Chinese MEMS players in the market.

Data from market research agency Yole shows that the global MEMS market will grow from $11.5 billion in 2019 to $17.7 billion in 2025, with a 7.4% compound growth rate.

The research of MEMS technology started in the 1950s; Its real development did not begin until the 1980s. So far, it went through three waves. The first wave was from the 1980s to the 1990s, with the automotive industry pushing the demands for MEMS sensors; The second wave occurred in the late 1990s to the beginning of the 21st century, when cell phones, home appliances, and other consumer electronics made MEMS more important.

Since 2010 there has been the third wave, driven by consumer electronics, automobiles, and medical applications. According to research firm Qianzhan's data, these three markets accounted for 44%, 24%, and 17% respectively in the global MEMS sensor market in 2020, followed by 9% in the industrial sector.

MEMS acoustic sensors are one example of their wide use in consumer electronics. Each smartphone requires 3-5 MEMS for its microphones. In the past five years, the global smartphone shipments were around 1.4 billion units each year, representing a huge market for MEMS; TWS headphones typically have 1-2 MEMS, and its global market value in 2020 exceeded $10 billion, with 350-400 million unit shipment. It is still growing at more than 30% a year.

In addition, in interactive smart speakers for the growing number of smart home systems, there are 2-8 MEMS for each other microphone, another vast potential.

The automobile is the second largest engine for MEMS's growth. For vehicles to change to be autonomous, connected, and electric, MEMS sensors have become indispensable with more advantages.

Multinationals such as Bosch, Broadcom, Qorvo, STMicroelectronics, Knowles, TDK, Infineon dominate the global and Chinese MEMS market. In response to the rapidly rising demands for MEMS sensors, they have expanded their production.

China began to develop the MEMS sensor industry more seriously since 2006. Related government departments have successively issued several policies to support and regulate the industry, drawing goals and development routes and promoting more MEMS applications.

Goermicro(歌尔微电子) has benefited from the MEMS microphones and joined the top ten MEMS manufacturer list in 2019, rising to sixth place in 2020.

Sai Microelectronics (北京赛微电子股份有限公司) joined the first-tier MEMS foundries after it acquired the Swedish company Silex in 2016 and has ramped up its capacity and output significantly since then.

Aosong Electronics(奥松电子) has started the MEMS chip foundry service business, one of the earliest in the country.

Compared with these multinationals, the Chinese MEMS manufacturers, overall, are still smaller in operational scale and produce lower value-added and less sophisticated products with fewer types. For them to become stronger, Luo Yingzhe, senior director of product engineering at Shanghai-based QST Corporation(矽睿科技), called on fellow industry professionals to step up R&D efforts and introduce more innovations in the industry supply chain.

More training for bringing out more talents is another task facing the industry. MEMS is an interdisciplinary technology involving electronics, machinery, materials, manufacturing, information, and automatic control. Industry experts at the MEMS conference advocated more cooperation with universities and institutes to turn out talents more efficiently.