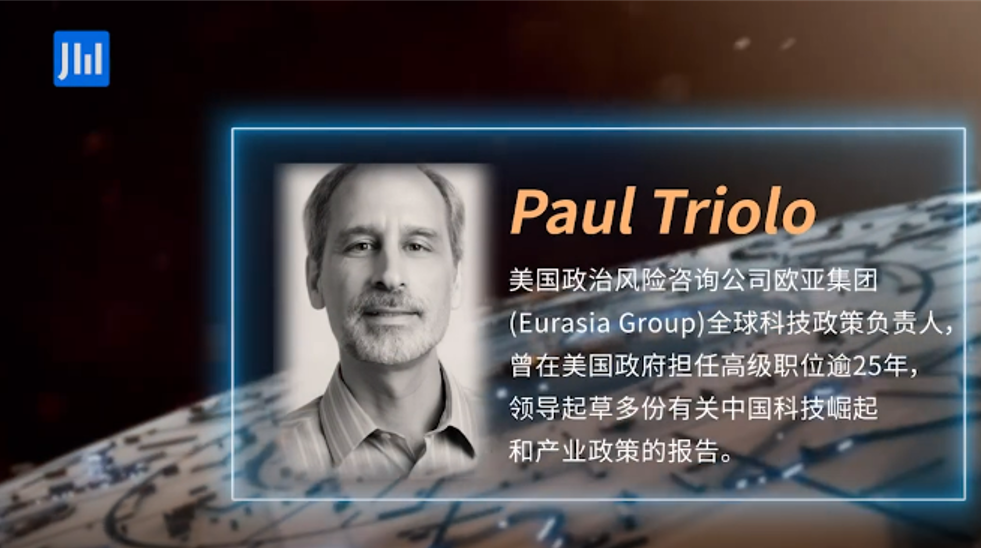

The U.S. Commerce Department put more restrictions on technology trade and prohibited U.S. companies from selling to China. Paul Triolo, Head of Global Tech Policy at Eurasia Group explained the development in a recent video interview with J.W. Insights’ Serena Deng.

Following is another excerpt of Paul Triolo’s answers in the interview:

There have been many calls in the U.S. Congress for putting further restrictions on those electronic design automation tools. Typically, those have not been subject to export controls. The entity list is just one piece of the export control system. The other piece is specific technologies - all the technology goes into one of the most advanced parts of semiconductor manufacturing, such as extreme ultraviolet lithography. This equipment is very complicated and valued at $150 million to $500 million - you need to manufacture at the most advanced nodes.

And the U.S. government has put pressure on the Dutch government, preventing it from issuing a license to ship that equipment to SMIC. So these export control actions on the part of the U.S. government and other things like disapproving companies in Europe from providing certain kinds of equipment to certain companies have also disrupted a little bit that sector. Because normally, ASML would probably sell a lot of EUV equipment to Chinese companies, not just SMIC but other companies in China.

And then recently, another foreign company, S.K. Hynix, which makes memories semiconductors wanted to put that equipment into a facility in Wuxi. And it wants to keep up with the competition. Other companies are using EUV in memory to make more advanced semiconductors. But the U.S. government vetoed that transfer of EUV equipment, which is arguably just within the company. It’s not in the sense of exporting to a Chinese company. But even that was considered to be of concern because that EUV technology is so advanced and controlled within the U.S. export control system and within the multilateral export control system under the Wassenaar Agreement, which is a voluntary agreement. The Netherlands is a member, and the Dutch government would honor that restriction if the U.S. government pushed that on that EUV equipment.

So, the export control intervention includes the entity list (an end user-based restriction) and technology. SMIC was also added to the entity list last year. And the U.S. companies could not ship equipment that was inherently designed for below ten nanometers. That was a very unusual entity list action taken by the Commerce Department to specify certain types of equipment. In this case, it caused confusion because usually equipment isn’t designed for a specific node. So the equipment that’s being used now, for example, SMIC dense ultraviolet lithography can go down in some cases to seven nanometers, depending on how you use it for certain kinds of production and certain kinds of layers in the semiconductor.

So there’s been a lot of debate about how should the U.S. industry interpret that. The effect is on the Chinese companies affected and the U.S. companies. Because U.S. companies dominate these sectors are losing a lot of revenue if they’re cut off from the China market. And the U.S. industry argument is that this is a national security concern because China is such a big market. Huawei, for example, was a huge buyer of U.S. semiconductors. The argument is that U.S. companies have benefited in plowing a lot of profit back into R&D and allowing them to continue to innovate and lead in their respective sectors and design advanced semiconductors, some of which are used by the U.S. government.

So the argument that the U.S. companies have made is interventions in this type of industry have to be done very carefully, because they could have these unexpected, negative consequences of undercutting the innovation capability of leading U.S. companies, particularly in the semiconductor equipment sector. Companies like Applied Materials, Lam Research and KLA-Tencor are our world leaders and dominate these sectors.

And Japanese companies like Tokyo Electron are also big players in that, and then ASML in Europe. But these companies are used to selling fairly freely into different markets and to different companies. And to the extent you’re starting to cut off those types of sales, the consequences should be carefully thought through before the U.S. government makes these decisions.

For the Huawei case, there didn’t seem to be a lot of thought that went into that action. Again, no clear guidance was given to BIS on how to license, for example. And so that’s an example of a policy that may not have been very well thought through and had unintended collateral damage to the global supply chain of semiconductors. And that’s the industry argument is interventions here should be done very carefully.

评论

文明上网理性发言,请遵守新闻评论服务协议

登录参与评论

0/1000