(JW Insights) Oct 19 -- China's mature process capacity share is anticipated to grow from 29% this year to 33% by 2027, propelled by policies and incentives promoting local production and domestic IC development, while the share of the Taiwan region is estimated to consolidate from 49% down to 42%, said a TrendForce report on October 18.

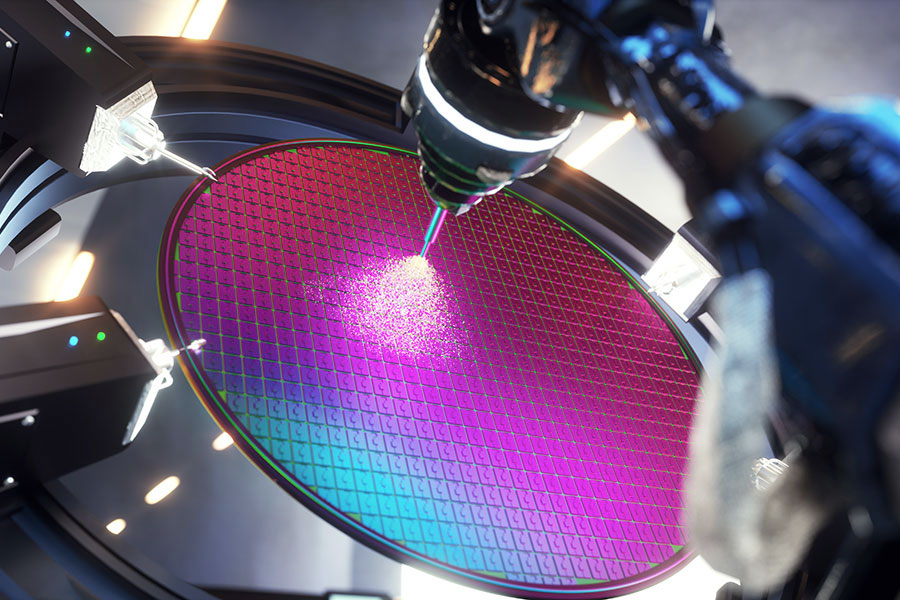

Leading the charge are giants like SMIC(中芯国际), HuaHong Group (华虹集团), and Nexchip (合肥晶合集成). Expansion predominantly targets specialty processes such as driver ICs, CIS/ISPs, and power discretes.

As China's mature process capacities continue to emerge, the localization trends for driver IC, CIS/ISP, and power discretes will become more pronounced. Second and third-tier foundries with similar process platforms and capacities might face risks of client attrition and pricing pressures, said TrendForce.

The Taiwan region's industry leaders, renowned for their specialty processes—UMC, PSMC, Vanguard, to name a few—will find themselves in the eye of the storm. The battle ahead will hinge on technological prowess and efficient production yields.

In a nutshell, while China actively courts both global and domestic IC designers to bolster its local manufacturing presence, the ensuing massive expansion could flood the global market with mature processes, potentially igniting a price war, according to the TrendForce report.

(Li PP)

评论

文明上网理性发言,请遵守新闻评论服务协议

登录参与评论

0/1000